Audit snapshot

What we reviewed and why

The State Budget sets out the SA Government’s fiscal strategy, current and estimated future financial performance, policy priorities and new initiatives. It is also a key tool to manage and monitor government activities and performance.

This report gives our insights into key trends and risks for the State’s public finances based on our review of the 2023-24 State Budget.

Our key insights

- Forecast net operating surpluses may not be achieved given several risk factors, including ongoing health and child protection funding pressures, wage agreement negotiations occurring during a period of high inflation, rising interest expenses and severe weather events.

- The challenging economic environment, including cost of living pressures on household budgets and the possibility of higher unemployment rates, increases the risk of unfavourable revisions to budget forecasts for GST revenue and payroll tax.

- There are several risks attached to the SA Government’s very large capital program, including delivering the Torrens to Darlington project and new Women’s and Children’s Hospital on time and budget given building industry capacity constraints.

- Rising debt and interest costs owing to the scale of the State’s capital program may constrain the State’s fiscal capacity and its ability to deliver services.

Key budget indicators

South Australia compares favourably to Victoria on key budget sustainability indicators, but is in a similar or less favourable position compared to the other states.

2022-23 GGS

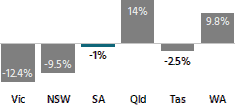

Estimated operating result

% of total revenue

2026-27 NFPS

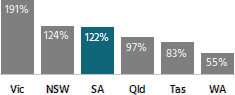

Net debt

% of total revenue

2026-27 NFPS

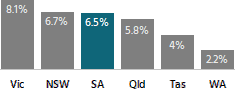

Interest expense

% of total revenue

S&P/Moody’s credit rating

Vic AA/Aa2 NSW AA+/Aaa SA AA+/Aa1 Qld AA+/Aa1 Tas AA+/Aa2 WA AAA/Aaa

Note: GGS refers to the general government sector and NFPS to the non-financial public sector. Appendix 2 of the report provides further details on what comprises these sectors.