CHAPTER 17

CASE STUDY IN ACQUISITION MANAGEMENT: THE OCEANIC CAPITAL CORPORATION

TABLE OF CONTENTS

17.1 INTRODUCTION

17.1.1 BACKGROUND

17.1.2 MAJOR OPERATIONS

17.2 KEY PARTICIPANTS AND CHRONOLOGY IN SUMMARY FORM

17.2.1 PARTICIPANTS AND THEIR ROLE

17.2.2 CHRONOLOGY OF KEY EVENTS

17.3 BASIS FOR ACQUISITION

17.3.1 STRATEGIC RATIONALE

17.3.2 INVESTMENT CRITERIA

17.4 RELEVANT OBSERVATIONS

17.4.1 TIMING AND BASIS OF TRANSACTION - ADVICE TO THE BOARD

17.4.2 PREPARATION OF SALE AGREEMENT

17.4.3 LACK OF FOLLOW UP OF KPMG PEAT MARWICK HUNGERFORDS ADVICE

17.4.4 RELEVANT CONCLUSIONS

17.5 FINANCIAL PERFORMANCE OF INVESTMENT

17.5.1 NINE MONTHS ENDED 30 JUNE 1988 ($15.2M LOSS)

17.5.2 YEAR ENDED 30 JUNE 1989

17.5.3 YEAR ENDED 30 JUNE 1990

17.5.4 YEAR ENDED 30 JUNE 1991

17.6 EFFECTIVENESS ASSESSMENT: THE BANK'S DUE DILIGENCE PROCESS AS APPLIED TO OCEANIC CAPITAL CORPORATION

17.6.1 BUSINESS FUNDAMENTALS AND RISK ANALYSIS

17.6.2 VOLUME OF FUNDS UNDER MANAGEMENT

17.6.3 QUALITY AND RETENTION OF KEY STAFF

17.6.4 QUALITY OF REPORTING SYSTEMS

17.6.5 FINANCIAL POSITION OF INSURANCE COMPANY

17.6.6 FINANCIAL REVIEW

17.6.7 ASSESSMENT OF VENDOR REPUTATION

17.7 OTHER RELEVANT MATTERS

17.7.1 BOARD INFORMATION

17.7.2 CONFLICT OF INTEREST

17.7.3 UNDERLYING CLARITY OF BOARD INFORMATION AND QUALITY OF COMMUNICATION WITH BANK EXECUTIVE

17.7.4 BOARD FOLLOW UP

17.7.5 SUPPORTING WORKING PAPERS

17.8 FINDINGS AND CONCLUSIONS

17.9 REPORT IN ACCORDANCE WITH TERMS OF APPOINTMENT

17.9.1 TERMS OF APPOINTMENT A

17.9.2 TERM OF APPOINTMENT C

17.9.3 TERM OF APPOINTMENT D

17.9.4 TERM OF APPOINTMENT E

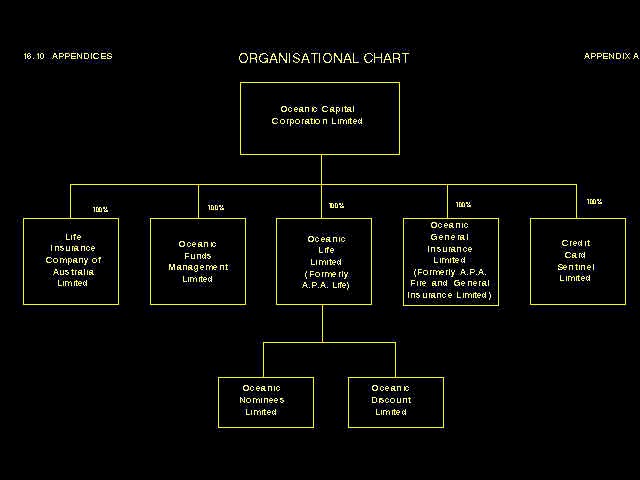

17.10 APPENDIX: ORGANISATION CHART

17.1 INTRODUCTION

Oceanic Capital Corporation Limited ("Oceanic Capital Corporation"), the holding company of an insurance and funds management group of companies (the "Oceanic Group"), was purchased in March 1988 for $59.0M. The Bank's key strategic goal was to acquire an established funds management operation.

Oceanic Capital Corporation was forecast to achieve a net profit after tax of $6.6M and $8.2M in 1988 and 1989, respectively. Its actual post-acquisition performance has been well below these early expectations, as indicated hereunder:

|

Years ended 30 June |

|||

|

1989 |

1990 |

1991 |

|

| Oceanic Group Net Profit/(Loss) after tax and extraordinary items |

1.5 |

4.2 |

(83.3) |

The poor performance has in part been influenced by post-acquisition events, such as the collapse in the property market and consequent impact on the property unit trust industry. Nevertheless, analysis of results indicate that a substantial amount of losses could have reasonably been anticipated by due diligence prior to acquisition.

The events and circumstances surrounding the acquisition of Oceanic Capital Corporation have been the subject of detailed examination by the Investigation to determine the shortcomings in the Bank's acquisition management which resulted in these losses.

17.1.1 BACKGROUND

The Oceanic Group of companies was formed on 31 August 1987 by an amalgamation of existing insurance and funds management businesses. The core activities of the Oceanic Group consisted of life insurance in Australia and New Zealand, funds management (the group then had approximately $392.0M funds under management), a small general insurance operation, and a majority interest in Credit Card Sentinel Limited, a credit card services company which provided services related to the loss of credit cards by the cardholders.

All of the share capital of Oceanic Capital Corporation was beneficially owned by APA Holdings Limited ("APA Holdings"). The original intention of APA Holdings was to have Oceanic Capital Corporation publicly floated by December 1987, however, the stock market crash in October 1987 caused these plans to be cancelled. Oceanic Capital Corporation was then offered for sale by private treaty. The Investigation was advised by Mr O Reichert, Associate Director Finance and Operations, of Oceanic Capital Corporation, that there were some ten parties expressing interest in Oceanic Capital Corporation and that the main competing bidder against the Bank was a management buy-out team.

On 31 March 1988, the Bank acquired 100 per cent of the share capital of Oceanic Capital Corporation from APA Holdings. The purchase price was $60.0M, subject to an escrow amount of $2.0M designed to accommodate any adjustments to the purchase price following detailed examination of the records of Oceanic Capital Corporation. At final settlement $1.0M was refunded following the identification of adjustments accommodated by the contract of sale.

17.1.2 MAJOR OPERATIONS

The major operations of Oceanic Capital Corporation are set out in the Appendix at the conclusion of this Chapter of the Report.

17.2 KEY PARTICIPANTS AND CHRONOLOGY IN SUMMARY FORM

17.2.1 PARTICIPANTS AND THEIR ROLE

The following table sets out the key participants in the acquisition of Oceanic Capital Corporation.

| Organisation/Name/Title | Description of Role |

| THE STATE BANK OF SOUTH AUSTRALIA |

| Mr T M Clark, Managing Director | Introduced the acquisition to the Bank. Held discussions with senior Oceanic Capital Corporation executives in relation to salary packages to ensure confidentiality in executives' salaries. Became a Director of Oceanic Capital Corporation after the acquisition. |

| Mr J B Macky, General Manager, Information Systems and Subsidiaries | Initial project leader for the Oceanic Capital Corporation acquisition. His role ceased after the Board meeting on 24 March 1988. |

| Mr K L Copley, Chief Manager, Finance and Planning | Member of Oceanic Capital Corporation acquisition team who assumed project leadership later in the transaction. Became a Director of Oceanic Capital Corporation after the acquisition. |

| Mr Copley advised the Investigation that Mr Guille (a senior bank executive) conducted a "short assessment of the executives involved in Oceanic Capital Corporation". Mr Guille regarded his role as related to gaining knowledge of the staff and personnel practices in Oceanic Capital Corporation. |

| Mr G S Ottaway, General Manager, Subsidiaries (Mr Ottaway assumed responsibility for subsidiaries from Mr Macky during the transaction) | Became a Director of Oceanic Capital Corporation after the acquisition, in accordance with his responsibility for subsidiaries. |

| EQUITICORP TASMAN LIMITED |

| Mr M Boyte, Managing Director | Provided valuation reports of Oceanic Capital Corporation management rights and life assurance business dated 14 August 1987 and 29 September 1987, respectively. These valuation reports were prepared by Mr Michael Smith and Mr Mark Clay of CIBC Australia Limited. The sale agreement for Oceanic Capital Corporation also identified Equiticorp Australia Limited ("Equiticorp") as a secured creditor of APA Holdings. File notes of Mr Copley indicated that this loan to APA Holdings was paid out by the Bank on the sale of Oceanic Capital Corporation. |

| OCEANIC CAPITAL CORPORATION

Mr J Purvis, Managing Director Mr I Brown, Finance Director Mr O Reichert, Associate Director, Finance and Operations |

| WESTGARTH BALDWICK

Mr J Munton |

Legal advisers to the Bank in respect of the acquisition of Oceanic Capital Corporation. |

| KPMG PEAT MARWICK HUNGERFORDS

Mr R Pitcher, Partner (Melbourne) |

Adviser to the Bank in respect of finance and accounting issues. |

| WILLIAM M MERCER, CAMPBELL, COOK & KNIGHT ("MERCERS") |

| Mr M Hughes Mr P Luk Mr C Latham |

Actuarial advisers to the Bank and Oceanic Capital Corporation. Mr Copley advised the Investigation that he was aware of the potential conflict of interest arising from consulting the Bank and Oceanic Capital Corporation. Nevertheless, he was satisfied that the conflict had been resolved by Mercers allocating different partners to consult for the Bank. |

| FREEHILL, HOLLINGDALE & PAGE

Mr T M Mistele |

Legal advisor to APA Holdings. |

| DELOITTE HASKINS & SELLS

Mr W R Finney, Audit Partner |

Auditor of Oceanic Capital Corporation. |

| APA HOLDINGS LIMITED ("APA HOLDINGS")

Mr G Carter, Chief Executive Officer (and controlling shareholder) |

Executive officers of the vendor. |

17.2.2 CHRONOLOGY OF KEY EVENTS

The following table sets out the key events which are fundamental to understanding the circumstances of the transaction.

Date Event

16 December 1987

Equiticorp Tasman Limited forwarded valuation reports by CIBC Australia Limited on the Oceanic Capital Corporation Management Rights and APA Life Assurance Limited. The covering letter addressed to Mr Clark, was signed by Mr Boyte, and refers to earlier telephone discussions.

January 1988 (est)

Bank management review the Oceanic Capital Corporation Information Memorandum, which was prepared by Oceanic Capital Corporation management.

9 February 1988

Mr Macky, Mr Copley and Mr Guille, Chief Manager Personnel (in the limited respect mentioned earlier) investigate the acquisition of Oceanic Capital Corporation, and prepare a Board recommendation (16 February 1988) requesting that the Directors approve the Bank entering into negotiations to acquire Oceanic Capital Corporation.

17 February 1988

Submission of a recommendation dated 16 February 1988 to the Bank Board seeking approval in principle to enter into negotiations for the acquisition of Oceanic Capital Corporation.

The Board Paper contained references to investigations which would be made, including:

. stating that the purchase would be subject to independent valuation by actuaries and accountants (item 2(c), page 1);

. proposing detailed examination of records by accountants (third last paragraph, page 5); and

. stating that the price would be subject to due diligence and adjusted according to any discoveries made (item 5, page 7).

The Board approved, in principle, entering into negotiations after a discussion of forty five minutes (as recorded in the Board Minutes of 17 February 1988), subject to the following terms and conditions relevant to the investigatory process:

"A satisfactory independent valuation by Consulting Actuaries and Accountants."

The Board Minutes did not refer to examination of records by accountants or the due diligence which was also referred to in the Board Paper.

Furthermore, the Board Minute did not specify whether the due diligence should be undertaken before or after acquisition. This matter had been left unclear in the Board Paper.

23 February 1988

Conference between Mr Pitcher (KPMG Peat Marwick Hungerfords), Mr Copley, and Mr Macky. Meeting discussed various issues in respect of Oceanic Capital Corporation and deal strategies.

Mr Pitcher told the Investigation, that it appeared to him at the time that a decision had been made to offer $55.0M for Oceanic Capital Corporation.

He had also suggested at that time that 20 per cent of the purchase price be withheld as a contingency sum. According to Mr Pitcher he had, up to this point, only been involved in talking over accounting and acquisition strategy issues. Mr Pitcher had not provided valuation advice, nor was his opinion sought on the value of key intangible assets.

25 February 1988

Board meeting held which referred to the approval in principle given on 17 February 1988, and noted that the Bank was currently formalising arrangements to make an offer of $55.0M subject to the conditions set out at the Board meeting on 17 February 1988, and with a $10.0M escrow amount payment which was only to be made "after satisfactory completion of investigations of the company's affairs by consulting actuaries and accountants."

The Board noted the progress in negotiations in the purchase.

The offer of $55.0M was made on 25 February 1988; APA Holdings rejected the Bank offer on 5 March 1988.

15 March 1988

Facsimile received from Mr Vickery (APA Holdings), addressed to Mr Macky, advising of the terms and conditions of an offer from another bidder for Oceanic Capital Corporation which it was alleged was being formalised. The facsimile invited the Bank to reconsider its offer and proposed negotiations in Adelaide if this was in prospect.

22 March 1988

The negotiations were reopened, at a higher price of $60.0M. The Bank knew that APA Holdings had cash commitments due at 31 March 1988, and Mr Copley has advised the Investigation that the Bank endeavoured to use this to its advantage. A Heads of Agreement was entered into between the Bank and APA Holdings for the purchase of Oceanic Capital Corporation which agreement contained a condition that the sale was subject to final approval of the Board being given on or before 25 March 1988.

24 March 1988

Recommendation for the acquisition of Oceanic Capital Corporation is presented to the Bank Board and Board approval for the purchase given (Minute 88/83).

30 March 1988

Approval given by Premier of South Australia for the purchase of Oceanic Capital Corporation by the Bank as required by Section 19(7) of the State Bank of South Australia Act, 1983 ("the Act").

22 to 31 March 1988

Preparation, completion and settlement of Sale Agreement. It has been stated by Westgarth Baldwick subsequently (facsimile 10 April 1990) that they made comments in relation to the Sale Agreement, basically, seeking clarification from Mr Copley on certain details of the transaction and suggesting additional warranties for the agreement. The facsimile dated 10 April 1990 to Mr Copley from Mr Munton of Westgarth Baldwick (discussed below) indicates that the advice regarding the warranties was not acted upon by Mr Copley. Initial settlement took place on 31 March 1988 with the payment of $60.0M to APA Holdings and other interested parties (including the Equiticorp Group) $2.0M of which was held in escrow by Freehill, Hollingdale & Page. The draft sale agreement received by the Bank on 25 March 1988 contained reference to Equiticorp as a beneficiary of the proceeds of the sale (refer clause 4.2 (a) (viii) of draft sale agreement).

Early April 1988

KPMG Peat Marwick Hungerfords requested to conduct enquiries at Oceanic Capital Corporation to determine whether any adjustments should be made to the purchase price in accordance with the contract.

6 April 1988

Mercers, the consulting actuaries, provided a financial position assessment of APA Life Assurance Limited which was to be acquired as part of the Oceanic Capital Corporation acquisition.

18 April 1988

Mercers provided an assessment of Oceanic Unit Trust operation (being trusts managed by Oceanic Funds Management Limited).

21 April 1988

KPMG Peat Marwick Hungerfords provided draft report to Mr Copley on their investigation of Oceanic Capital Corporation which was discussed with Mr Copley on 22 April 1988. Furthermore, on 26 April 1988 KPMG Peat Marwick Hungerfords wrote to confirm the discussions held with Mr Copley in respect of the draft report on 22 April 1988. KPMG Peat Marwick Hungerfords warned that "the nature and quantum of matters being uncovered is such that it is clearly essential... that we carry out further in-depth examinations...". According to Mr Pitcher, KPMG Peat Marwick Hungerfords raised serious concerns over Oceanic Capital Corporation, and were preparing to develop strategies to pursue significant claims under warranties.

27 April 1988

Mr Copley reported to the Board of directors on the progress in the investigation of Oceanic Capital Corporation. The concerns raised by KPMG Peat Marwick Hungerfords and Mercers were not revealed. However, Mr Copley confirmed to the Board that most of the issues raised were identified at the time of the initial investigation, and that he was still satisfied that the purchase price was fair and reasonable.

29 April 1988

The final KPMG Peat Marwick Hungerfords report on the investigation is issued. Mr Pitcher has advised the Investigation that KPMG Peat Marwick Hungerfords were not requested to follow up on the concerns raised in their report or their letter of 26 April 1988, nor were they ever requested to conduct further work.

17 to 20 May 1988

Various replies received by Mr Copley from Oceanic Capital Corporation, its auditors and the vendors disputing issues raised by KPMG Peat Marwick Hungerfords.

27 May 1988

Deed of Settlement/Deed of Release entered into, parties agreed to split the $2.0M escrow sum. It is important to note that the Deed of Release released the vendor from any future warranty obligations except a taxation warranty which subsequently has proved ineffective in respect of a major taxation liability (discussed later in this report).

17.3 BASIS FOR ACQUISITION

17.3.1 STRATEGIC RATIONALE

The strategic rationale for the purchase of Oceanic Capital Corporation was set out in a recommendation ("Oceanic recommendation")(), dated 22 March 1988 discussed by the Bank Board of Directors at their meeting on 24 March 1988 and was also discussed in an earlier Board submission dated 16 February 1988. The Oceanic recommendation was prepared by Mr Macky, General Manager, Information Systems and Subsidiaries and Mr Copley, Chief Manager, Finance and Planning. The Oceanic recommendation was presented to the Board by Mr Macky on 24 March 1988. A Bank Board Minute (88/83) records the Board's approval for the purchase of Oceanic Capital Corporation.

The strategic rationale for the purchase appears from the Oceanic recommendation to be as follows:

(a) Oceanic Capital Corporation would generate income derived from management of third party assets and therefore would enhance profitability without a detrimental effect on the Bank balance sheet ratios. This was perceived to assist in achieving a targeted return on equity and assets for the Bank Group.

(b) Oceanic Capital Corporation would provide a funds management capability which was "deemed as being necessary in order to provide the expertise to manage the Bank's superannuation funds, and to enable the generation of products for sale through the branch network." ()

(c) The acquisition would allow for geographic expansion and provide access to new markets for the Bank because the activities and markets of Oceanic Capital Corporation were mostly located in the eastern states, Western Australia and New Zealand.

(d) The Bank's Personal Finance Services division had been undergoing growth, and there had been growth in the general market for investment advice and products; Oceanic Capital Corporation was perceived as being capable of meeting a demand for a diversification of investment products.

Interviews conducted by the Investigation with Mr Macky and Mr Copley confirmed that the above items were the strategic objectives of the Bank. The acquisition of a funds management capability was stressed as being extremely important and the acquisition of Oceanic Capital Corporation was considered preferable to:

(a) setting up a funds management company; or

(b) expanding the role of Executor Trustee & Agency Co, which had specialist skills in cash management.

17.3.2 INVESTMENT CRITERIA

The Oceanic recommendation also set out the financial criteria upon which the investment in Oceanic Capital Corporation was justified to the Bank Board. This is described below under the topics of (a) Profitability; and (b) Net Asset Value.

(a) Profitability

The Oceanic recommendation included an attachment which set out a profit summary of the actual combined results of the businesses and entities comprising the Oceanic Group for the period from 1982 to 1987 and also included projections for 1988 and 1989. The table below sets out the most relevant components of that summary being the actual result for 1987 and forecasts for 1988 and 1989.

|

Years ended 30 September |

|||||

|

Item |

Actual |

Forecast |

Forecast |

||

| Operating Profit Before Tax |

3.1 |

6.7 |

8.4 |

||

| Income tax expense |

(0.9) |

(0.7) |

(0.4) |

||

| Operating Profit After Tax before extraordinary items |

2.2 |

6.6 |

8.2 |

||

| Extraordinary items |

(7.8) |

- |

- |

||

| Net Profit/(Loss) After Tax |

(5.6) |

6.6 |

8.2 |

||

The extraordinary item in 1987 comprised write-offs related to the group formation in August 1987 and also included a $6.0M write-off relating to the diminution in value of fund management contract rights due to the decline of funds under management.

It should also be noted that the 1989 forecast provided above was originally $11.7M, but was revised downwards by 30 per cent by Mr Macky and Mr Copley because they believed the assumed increase in operating profit was unrealistic.

The relevant discussion on forecasts from the Oceanic recommendation is set out below:

"PROFITABILITY

Attachment 4 is a profit summary providing actual results for the period 1982 to 1987 and with projections for 1988 and 1989. The projections for 1989 demonstrate an increase in operating profit from the actuals of 1987 to the projected of 1989 of 283%. We are of the opinion that this is unrealistic and accordingly have adjusted the 1989 projection down by 30% in order to provide what we consider to be attainable projections.

The new management of the group are extremely confident in improving the profitability of the company. That confidence is shared by Messrs Macky and Copley.

We have been provided with profit figures for the four months to 31st January 1988 which show that the group has made a profit in that period of $3,473,000.

This includes two special profits; an unbudgeted incentive fee of $588,000 and a fee of $700,000 relating to 1987. Thus the ordinary operating profit for the period can be adjusted to $2,185,000. This indicates that the profit projection for 1988 of $6.6 million is attainable and would provide a level of profitability which although not at the 15% criteria sought from subsidiary companies of State Bank, is sufficient to cover the cost of the capital necessary to make the investment."

The Oceanic recommendation did not specify the cost of capital used in this assessment or how it had been calculated, nor has the Investigation team's search located, or had produced by the Bank, any working papers to support this calculation.

The forecast for 1988 was supported by the results for the four months to 31 January 1988 which indicated a profit of $3.5M. Mr Copley identified in that result an unbudgeted incentive fee of $0.588M and income of $0.7M which actually related to the prior year. He therefore concluded that the operating profit for the period was $2.2M which, on an annual basis, approximated the $6.6M forecast. He also indicated to the Investigation that it was anticipated at the time that the operations of Oceanic Capital Corporation would generate synergistic benefits, although there had been no attempt to specifically identify and quantify such benefits. The assessment of forecast earnings was critical to the evaluation of the investment.

As will be discussed in detail in this Chapter the assessment of the achievability of forecast results was seriously deficient, because it failed to:

(a) review and confirm the accuracy of the reported result for the four months ended 31 January 1988;

(b) critically analyse the underlying assumptions upon which the forecasts were based;

(c) heed the observations made by the consulting actuaries, William M Mercer, Campbell, Cook & Knight ("Mercers") who questioned the achievability of the fund management operations' projections; and

(d) assess and appraise the budget and forecast setting procedures of Oceanic Capital Corporation management, which would be relevant in determining the likely reliability of management forecasts.

Based on the evidence and for the reasons stated in this Chapter, I am of the opinion that Mr Copley and Mr Macky failed to exercise proper care and diligence in assessing the forecasts presented by Oceanic Capital Corporation management.

(b) Net Asset Value

The Investigation was advised in interviews with Mr Copley that the purchase price for Oceanic Capital Corporation was determined principally on an assessment of the "balance sheet assets" rather than a specific assessment of "ongoing earnings".

In the first Board recommendation dated 16 February 1988 (seeking approval in principle to proceed with negotiation for the acquisition of Oceanic Capital Corporation, which was granted by the Board on 17 February 1988, subject to important terms and conditions), a detailed analysis of the valuation of balance sheet assets was provided. The summary set out below is extracted from that Board recommendation, and gives the initial assessment of the value of assets made by the Bank's management on their initial review of Oceanic Capital Corporation.()

|

Item |

$M |

|

Net Assets at 30 September 1987 |

81.9 |

|

APA Holdings Subordinated Loan |

(4.1) |

|

77.8 |

|

|

Adjustments: |

|

|

(a) Write-down of investments |

(0.9) |

|

(b) Write-down of management rights |

(1.2) |

|

(c) Write-off Life Assurance Licence valuation |

(3.0) |

|

(d) Write-off Life Assurance Agency valuation |

(17.0) |

|

(e) Write-off goodwill on acquisition |

(1.3) |

|

Net Assets at the Bank Management valuation |

54.4 |

The Bank Board Paper of 16 February 1988 provided the following explanations of the adjustments above:

(a) Investments were revalued to "... reflect their current values".

(b) "... Management Fund Rights reduced by $1.235M to reflect 7.5% of the current value of the fund." () The value of management fund rights was determined by Mr Macky and Mr Copley to be 7.5 per cent of the value of funds under management. In interviews with the Investigation, Mr Copley stated that 7.5 per cent was, in his opinion, reasonable, and was supported by a valuation prepared by CIBC Australia Limited ("CIBC Australia") dated 14 August 1987 (before the stock market crash of 19 October 1987). The CIBC Australia report was prepared for APA Holdings in preparation for the intended public listing of Oceanic Capital Corporation. The adjustment of $1.235M was to reflect the decreased value of management rights due to the reduction of funds under management.

(c) to

(e) Reflected full writedowns of those intangible asset valuations because "... [Mr Macky and Mr Copley] believe they have no value".

It should be noted that of net assets of approximately $86.5M, some $80.5M related to "intangible assets" or, in the case of the retained earings of the Life Assurance Statutory Fund, assets not yet recognised in the balance sheet of Oceanic Capital Corporation. The position can be stated as follows():

|

$M |

|

|

Management contract rights (contracts to manage certain public unit trusts and which provide a right to future management free income) |

19.2 |

|

Life Assurance |

|

|

39.6 |

|

17.4 |

|

3.0 |

|

Goodwill on Consolidation (recognised on the purchase by Oceanic Capital Corporation of the group operating companies on 31 August 1987.) |

1.3 |

|

Total |

80.5 |

The resultant adjusted net assets of approximately $55.0M provided the basis for the first bid of $55.0M for Oceanic Capital Corporation, which bid offer was made by Mr Macky in a letter dated 25 February 1988. The offer required a $10.0M escrow sum, with adjustments to the purchase price being made on the basis of verification and valuations by consulting actuaries, accountants and property valuers. Mr Copley has stated in interviews with the Investigation that, in his view, the $55.0M assessment represented the real value of Oceanic Capital Corporation, and he attempted to achieve this outcome in the final purchase price.

In connection with the asset assessment mentioned above, I regard it as illogical and unwise to acquire an investment as a going concern where that investment comprised such a high proportion of intangible assets, on a valuation basis other than one related to future earnings potential. Furthermore, not only did the Bank management fail to adopt a valuation approach based on future earnings potential, they also failed to adequately assess the earnings potential of Oceanic Capital Corporation in their investigations.

In order to record the acquisition of Oceanic Capital Corporation in the Bank's accounts, an assessment of the consolidated balance sheet of Oceanic Capital Corporation, at 31 March 1988 (the acquisition date) was required. This assessment was actually made on 13 July 1988 some three and a half months after the acquisition date, although there is nothing particularly unusual about the lapse of time actually taken to perform the assessment. In accordance with generally accepted accounting practice (and consistent with Approved Accounting Standard ASRB 1013: Accounting for Goodwill) the Bank was obliged to determine the fair market value of all assets and liabilities of Oceanic Capital Corporation, at 31 March 1988, in order to determine the opening balances for consolidation in the State Bank Group accounts.

This process and the adjustments made are generally referred to as "purchase accounting". Any valuation adjustments to either assets or liabilities made in purchase accounting are reflected as "pre-acquisition" adjustments to the book value of assets and liabilities acquired (Oceanic Capital Corporation) and are not included in the post-acquisition profit and loss statement. The State Bank Group profit and loss statement should therefore only reflect the results of "post-acquisition" activities of the Bank's subsidiaries.

The Investigation reviewed the purchase accounting entries made at acquisition date, effectively recording the opening balances at valuation. It was noted that the net assets of Oceanic Capital Corporation were written down to precisely the purchase price (approximately $59.0M) resulting in no goodwill or premium arising on consolidation. The Investigation also found that the asset write-downs finally made in the accounts of Oceanic Capital Corporation did not correspond with either the initial valuation assessments disclosed to the Bank directors (shown above) or the recommendations of KPMG Peat Marwick Hungerfords or Mercers.

The significant differences in the sequence of revaluation adjustments are set out below:

|

Decreased to |

|||

|

Item |

Initial |

KPMG |

Actual |

| Elimination of policy holder’s share of unrealised gains on property |

- |

7.4 |

7.8 |

| Overstatement of Deferred Acquisition Costs |

- |

0.8 |

2.4 |

| Write-down of Life Licence |

3.0 |

2.5 |

0.5 |

| Write-down of Life Agency |

17.0 |

17.4 |

3.9 |

| Increase in GAAP liabilities of Life Assurance Statutory Fund |

- |

- |

3.0 |

A review of the Board Minutes and supporting papers indicated that these material valuation adjustments were not brought to the attention of the Bank directors. Given the original premise (as advised by Mr Copley) that the purchase price was justified on the basis of net asset values, I would have expected the final asset configuration to have been advised to the Board as a matter of course and certainly when the final accounts of the Bank for the year ended 30 June 1988 were considered and approved.

Furthermore, there is some question concerning the reliability of the valuation of the intangible assets, in particular, of Management Contract Rights ($19.2M) earlier discussed but which were not adjusted above. Concerns were expressed by Mercers in the report dated 6 April 1988, which also questioned the achievability of the fund managers' profit plan and the value of the funds management company. Interviews with Mr Copley and reviews of relevant document files of Mr Copley indicate that these issues were not followed up by Mr Copley during the course of the due diligence review, or reported to the Bank Board. Mr Copley told my Investigation that he had been instructed by Mr Clark to `back off' and leave the integration and management of Oceanic to Mr Ottaway and the Oceanic management. He also said that as the obtaining of the report from Mercers and Mr Pitcher after acquisition was for the purpose of negotiating the return of the amount in escrow, he believed the passing of the reports to Oceanic management completed his management responsibilities in the matter.

Mr Clark agreed that although he may have indicated to Mr Copley that the integration and management of Oceanic was to be left to others, at no time did he even suggest to Mr Copley that he was to curtail his due diligence responsibilities. The full text of Mercers conclusion is quoted from their report below:

"CONCLUSIONS

(a) James Purvis' business plan can no longer be justified in the post-crash environment. It is not even known whether sales will be able to offset redemptions in the foreseeable future. The fund size has returned to September 1986 level and is likely to stay at that level (if not decline further) for quite some time to come.

(b) Management indicated that the 1987 expenses of $8.5M included some extraordinary items. It further indicated that this could be cut down to about $3.7M if no further marketing thrust was undertaken.

(c) A possible pro forma statement for the next few years will therefore look like:

|

Net service fee |

100,000 |

|

Management fee (@ say 1.2%) |

2,400,000 |

|

Total |

2,500,000 |

|

Expenses |

(3,700,000) |

|

Pre-tax surplus |

(1,200,000) |

(d) Based on the above we find it difficult to assign a substantial value to the fund management company except to the extent that the expertise developed over the years and the tax loss carried forward must be worth something.

This opinion will have to be revised if it can be demonstrated, or if one has good reason to expect, that the management is able to reduce the expenses to a level well below that suggested above.

(e) As of today the probability that the contingent liabilities mentioned in Notes 17(a) (in relation to Oceanic Property Trust) and Notes 17(c) (in relation to Oceanic Mortgage Trust) to the accounts will materialise is small."

In my opinion, the valuation of the management rights included in the acquisition accounts at $19.2M appears excessive, given that:

(a) the fund management company was not profitable; and

(b) the collapse of the stock market in October 1987 resulted in loss of funds under management and created a general level of uncertainty for funds managers at the time.

In my opinion, it was wrong for Mr Copley and Mr Macky to rely, as they said they did, on the CIBC Australia Report to confirm the value of the Management Rights and to support their valuation methodology, for the following reasons:

(a) The CIBC Australia Report was prepared for the vendors ("APA Holdings") and not the Bank.

(b) The CIBC Australia Report was prepared for specific purposes which were not related to the transaction which the Bank was contemplating.

(c) The CIBC Australia Report applied three valuation methodologies, one of which was "Percentage of Funds under Management", the method used by Mr Macky and Mr Copley. The other two methodologies provided in the CIBC Australia Report were "Capitalised Operating Revenue Approach" and "Discounted Cashflow Approach". These are earnings based methodologies which used profitability forecasts included in a business plan prepared by Mr Purvis. As the CIBC Australia Report used two earnings based methodologies, it was not reasonable to have assumed that the only appropriate valuation approach was the "Percentage of Funds under Management" approach. Indeed, in my opinion, the valuation of Management Rights should be primarily based on an earnings methodology with reference being made to the "Percentage of Funds under Management" as a subsequent cross-check of any valuation made, any material differences in which would warrant reconciliation.

(d) The CIBC Australia valuation was prepared in August 1987, which was prior to the stock market crash in October 1987. On all of the evidence, the stock market crash would have had a significant impact on the immediate prospects of the fund management operation and therefore its value. The forecast profits used for the purposes of the CIBC Australia valuation were obtained from the business plans prepared by Mr Purvis which has been questioned by Mercers in their report of 6 April 1988.

(e) The CIBC Australia Report was based on capitalisation rates determined by comparisons made with publicly listed companies prior to the stock market crash. In my opinion, it would have been obvious to any reasonably competent businessman that these statistics would have required revision for the consequences of the stock market crash.

On the basis of the above mentioned matters, I am of the opinion that Mr Copley and Mr Macky failed to exercise proper care and diligence in discharging their responsibilities for the proper assessment of the value of Oceanic Capital Corporation and ensuring the Board was adequately informed on asset values.

17.4 RELEVANT OBSERVATIONS

17.4.1 TIMING AND BASIS OF TRANSACTION - ADVICE TO THE BOARD

A key feature of the Oceanic Capital Corporation acquisition was that the investment was made prior to completion of a detailed due diligence investigation. Whilst the investigation by KPMG Peat Marwick Hungerfords did locate issues which would normally be found in a due diligence examination, their investigation was not requested until after settlement on 31 March 1988.

The commercial judgement of the Bank management in proceeding with the transaction on this basis must be seriously questioned because the escrow amount (contingency sum) of $2.0M was unlikely to be sufficient to recover any significant adjustment in the purchase price. It was also substantially less than the escrow of 20 per cent of purchase price (which would have been $12.0M) or the $10.0M escrow included in the initial offer by the Bank for Oceanic Capital Corporation, dated 25 February 1988. Any larger claims would therefore only be recoverable under the warranties in the sale agreement, which immediately placed the Bank at a disadvantage, because any recovery under warranty would be subject to:

(a) the ability of the Bank to legally enforce the relevant warranty (which has not proven possible in respect of subsequent taxation warranties);

(b) the financial capability of the vendor to honour any warranty obligations which might prove to be legally enforceable (this is of particular importance because, at the time of the transaction, it was publicly believed that the vendor and its related companies were under financial pressure and the Bank had endeavoured to exploit this circumstance in negotiation);

(c) being able to identify the claim within the defined warranty period; and

(d) the costs and time delays involved in enforcing the warranties.

In my opinion, the basis of the transaction was not adequately presented in the Oceanic recommendation for the following reasons:

(a) It was not stated explicitly that the due diligence examination would be undertaken after initial settlement.

(b) The nature, extent, and results of due diligence enquires, to date, (and related limitations pending the advice of consultants, accountants and actuaries) were not explicitly stated.

(c) The extent to which the terms and conditions of the previous "approval in principle" (Board meeting 17 February 1988) had, or had not been, fulfilled were not clearly stated.

(d) The fundamental risks in the transaction and the steps taken to investigate them were not summarised.

(e) The methods adopted to carefully assess the new management team were not explained.

(f) The limited review which had been conducted on future profitability was not explained.

(g) The limited extent of detailed investigation of the respective book values of intangible assets was not discussed, nor were changes in the earlier (16 February 1988) opinion of Mr Copley and Mr Macky on the value of certain key intangibles (Life Agency) reconciled within the Oceanic recommendation of 22 March 1988.

(h) The recommended escrow sum of $2.0M was not justified; nor was it reconciled with:

(i) The $10.0M escrow sum included in the 25 February 1988 Bank offer for Oceanic Capital Corporation.

(ii) The recommendation by Mr Pitcher (KPMG Peat Marwick Hungerfords) on 23 February 1988, that a contingency sum equivalent to 20 per cent of the purchase price (or $12.0M based on $60.0M purchase price) be withheld.

Moreover, the taxation exposures of Oceanic Capital Corporation were not disclosed and explained.

I have received a submission from Piper Alderman, Barristers and Solicitors, on behalf of certain past directors and two present directors (the "Piper Alderman Submission" dated 19 November 1991) which also states that the recommendation to acquire Oceanic Capital Corporation dated 22 March 1988 was received late, and the further recollection of some of the directors for whom they act that it may actually have been received by the Board at its meeting on 24 March 1988. Clearly if this did occur, it is most unsatisfactory communication of such a material transaction, although I am unable to make a firm finding regarding this matter.

Management's perception of the Board was relevant in their consideration of the nature and depth of information to be provided to the directors. It has been stated to the Investigation, by Mr Copley, that information had been provided to the Board on earlier occasions and that the directors had typically shown "no reaction". In his view the Board, at the time of the Oceanic recommendation was "not a terribly ... active Board". Mr Copley's assessment is to be contrasted with that of Mr Clark in respect of another unrelated transaction dealt with in Chapter 18 - "Case Study in Acquisition Management: The United Building Society" ("United Bank"). Mr Clark's comments in respect of the acquisition of United Bank described his assumption of the degree of knowledge of directors. In this context he identified the Board members as including a leading accountant, a leading lawyer and leading businessmen, who would be assumed to identify key commercial considerations and raise relevant questions if any such matters were unclear in Board Papers. Mr Copley asked the Investigation to note that in the intervening period between the time of his comment and that of Mr Clark, the Board had gained a new Chairman and had changed its attitude.

In my opinion, it is the right of a Board - especially the State Bank Board - to expect the submission of papers, in support of recommendations, which are complete, comprehensive, accurate, explicit, relevant, unambiguous and submitted in a timely fashion. It is the role of the executives to ensure, honestly, diligently and objectively that the Board has all the relevant facts in such a form as to enable it to make an informed decision on matters before it. In my opinion, the Board with respect to this particular transaction was not afforded information that met these standards. Accordingly, on the basis of the evidence, I am of the opinion that the executives primarily responsible for the preparation of the Oceanic Capital Corporation related Board Papers, ie Mr Copley and Mr Macky, failed to exercise proper care and diligence in relation to this aspect of the matter.

The information upon which the Board based their decisions was materially deficient in the areas discussed in detail above. The provision of this information was the responsibility of Mr Copley and Mr Macky.

17.4.2 PREPARATION OF SALE AGREEMENT

The following extracts of a facsimile, dated 10 April 1990, from Mr Munton of Westgarth Baldwick's to Mr Copley, recount the circumstances surrounding the preparation and finalisation of the Sale Agreement. The facsimile was prepared in response to an inquiry from Mr Copley when the Bank subsequently discovered that it was not able to recover taxation liabilities (to be discussed below) from the vendor. The facsimile states (in part):

"As you will recall the Agreement for Sale and the Deed of Release were drafted by Freehill Hollingdale and Page acting for APA. Although during the negotiations we requested substantial amendments to the documents (in particular to the warranty provisions) these were rejected by the vendor." [paragraph 3]

"You will also no doubt recall that at a meeting which took place prior to signing of the Agreement for Sale and which included yourself, Andrew Lumsden from this firm and myself [sic]. Our file note indicates that Ian Rischbieth was present for at least part of the meeting. At that meeting we explained to you that we were most unhappy about the form of the document and considered that it potentially left the Bank exposed on a number of issues. Your decision at that time was however that the consideration being paid for the company was below market and therefore you were prepared to accept these risks." [paragraph 4]

Mr Copley advised the Investigation that the short time available to prepare the Sale Agreement (22 to 31 March 1988) did not leave sufficient time to negotiate and incorporate the suggested amendments of Westgarth Baldwick. He was also of the view that a lot of what Westgarth Baldwick was suggesting at that late stage was "point scoring" against their opponents. Mr Copley recalled, however, that a senior Bank solicitor, Mr Rischbeith, was present with him at that meeting for the purpose of ensuring that the settlement documents were satisfactory.

Mr Copley told the Investigation that he could not recall specifically whether he consulted Mr Rischbeith as to whether the documents without the Westgarth Baldwick suggested amendments were satisfactory, but he said that having regard to his practice he would have done so. He said he could recall Mr Rischbeith having an opportunity to look at the suggested amendments, but was unable to recall whether Mr Rischbeith made any comments about them.

Mr Rischbeith has told the Investigation that his involvement in the Oceanic Capital Corporation acquisition as the Bank's legal advisor was minimal, and this was confirmed by Westgarth Baldwick in an interview with the Investigation.

Mr Copley acknowledged, however, that his decision to proceed with settlement of the purchase, notwithstanding Westgarth Baldwick's unhappiness about the form of the document, was based upon the critical factor of timing, namely, that the deal had to be completed and consummated by close of business on 31 March 1988, and because he considered the suggested amendments to be minor.

Mr Copley told the Investigation that he regarded both Westgarth Baldwick and Mr Rischbeith to be the "legal advisors" for the purposes of the Oceanic recommendation which stated that the Sale Agreement be subject to:

"...

4. The preparation of a legal agreement in a form acceptable to our respective advisers incorporating the above conditions and such other terms as are normal in this type of transaction."

This recommendation provided the terms and basis of Bank Board approval for the purchase of Oceanic Capital Corporation.

Neither Mr Rischbeith nor Mr Munton, of Westgarth Baldwick, regarded Mr Rischbeith as falling into the category of "legal advisor" for the purposes of the Oceanic recommendation and having regard to Mr Rischbeith's minimal involvement in the acquisition Mr Copley was not justified in so regarding him.

Mr Copley's decision to reject Westgarth Baldwick's advice and to proceed in the circumstances outlined above was contrary to the Oceanic recommendation.

As a result, the already disadvantaged position of the Bank was worsened because it was left exposed to potentially inadequate warranties in the Sale Agreement.

The comments of Mr Munton, quoted above, indicate that Mr Copley was on notice that the proposed Sale Agreement without the warranties which they regarded as necessary was not in the best interests of the Bank, and the decision to reject their advice was outside the authority given by the Bank Board.

17.4.3 LACK OF FOLLOW UP OF KPMG PEAT MARWICK HUNGERFORDS ADVICE

KPMG Peat Marwick Hungerfords informed Mr Copley of significant issues arising from their investigations and recommended in their letter dated 26 April 1988 that further detailed work was required. The text of that letter (which is reproduced in full below) also implies that future claims under warranties were envisaged at the time, and is consistent with the account of events given by Mr Pitcher to the Investigation.

"26 April 1988

PERSONAL PRIVATE AND CONFIDENTIAL

Mr K Copley

Chief Manager

Finance and Planning

State Bank of South Australia

97 King William Street

ADELAIDE SA 5000

Dear Kevin

I confirm our discussions in Sydney last Friday during the review of our preliminary report and our subsequent telephone conversation on the weekend concerning still further notifiable matters against the Vendor.

Because of the time constraints for next Friday we are finalizing our report in its present state of completion to enable you to impact upon the escrow withheld sum. The nature and quantum of matters being uncovered is such that it is clearly essential, as agreed in our discussions last Friday, that we carry out further in depth examinations of the Oceanic Group and the Managed Funds to be as reasonably satisfied as one could expect to be that all material downsides are identified and brought to account.

As part of the examinations and verifications we carry out following Friday 29 April, we will thoroughly review the management financial statements and reports to 31 March 1988 so as to give you and your Company the appropriate comfort as to the reliability and accuracy of what becomes the starting point for the new owner. This will also substantially assist you in establishing the pre-acquisition starting point. It will provide the measuring base for the performance of the Management Team now responsible to your Company and in doing so the figures we resolve upon for you will have washed away any further opportunity for management to draw on problems or events impacting now but resulting from the past because we will ensure that they are booked as of 31 March 1988.

Sentinel will receive even further attention from us. You are obviously and properly very concerned at what we have uncovered in the structuring, restructuring and disposal of Sentinel to the Life Company. Although we have only had a very brief time to look into the activities of Sentinel from what we have been able to piece together we believe the losses for the full year will be very considerable as set out in our report. Further, that losses will continue into the future. In accordance with your request we will thoroughly appraise the activities of Sentinel and provide you with our view of what the projections should realistically be for the periods ahead. My present view is that immediate consideration should be given to disposing of the business to another party or perhaps to the USA Partner. If a disposal alternative is not available then closure may be appropriate, both to cut losses and to have management concentrate on core business. Even if the losses are finally wound down to a profit in say three years time, there is no evidence at this early stage that ultimate profitability will be of a level sufficient to support the size of the investment having in mind that in two to three years time the investment (losses including the writing off of deferred expenditures) could well be of the order of $10.0M plus.

Turning to the Managed Funds, you will gather from our report that the management companies have not been conducting the affairs of the funds as they should. Our review of the funds and the management thereof will be directed to the fundamental issues of asset existence, fund records and identification and reconciliation of unit holders, distribution procedures and activities, fund reporting, management conduct.

In this short period of three weeks we have now gathered more than enough evidence to indicate that what you are being advised by Oceanic as being in order or under control or provided for - is not in fact the case. I do not wish to imply any intention on Oceanic's part to mislead (I should hope not) but perhaps out of a lack of attention to detail and fully informing themselves on the facts and/or the broader implications of certain actions they have taken before responding to your questions or making authoritative statements.

Finally, following our discussions with your Company's Solicitors in Sydney for clarification of the warranties and escrow clauses of the Contract, I confirm my recommendation that any of the matters we have uncovered which are lacking in specifics due to the need for more time and documentation to get the specifics, such items should not be notified on Friday. All of the definitive issues where you believe a litigation course is not the more appropriate one to take, should be notified because the escrow section of the Contract then ensures that everyone of these items must be dealt with by the expert and a decision made in June. You therefore avoid the pain of long drawn out litigation proceedings. Those items which are not notified on Friday are, according to the advice of your Solicitors, fully claimable under the warranty sections of the Contract provided they are identified within twelve months of March 1988. With regard to the major controversial item of the allocation of the surplus arising from the revaluation of property between the policy holders and the shareholders in the life company ($7,350,000), we are making every endeavour to obtain authoritative third party support of our views so as this item can hopefully become a notified item to be tabled no later than noon on Friday 29 April 1988.

Yours sincerely

Ron [Emphasis Added]"

Mr Pitcher and Mr Copley confirmed with the Investigation that no further work by KPMG Peat Marwick Hungerfords was requested after 29 April 1988, and no further work was performed. Mr Copley, however, stated that he had discussed the issues raised in the KPMG Peat Marwick Hungerfords and Mercers report with Oceanic Capital Corporation management and the external auditors of Oceanic Capital Corporation, Deloitte Haskins & Sells. He advised the Investigation that at the time he had felt that the issues of concern were resolved in these discussions, although with the benefit of hindsight he conceded that adequate follow up had not been performed. He advised the Investigation that the Board was not advised of the contents of either the KPMG Peat Marwick Hungerfords or the Mercers reports.

The Investigation reviewed the correspondence between Mr Copley, APA Holdings, Oceanic Capital Corporation and Deloitte Haskins & Sells in respect of the issues raised by KPMG Peat Marwick Hungerfords in their report of 29 April 1988. This correspondence only revealed a debate over the specific items raised by KPMG Peat Marwick Hungerfords in that report, in the context of disputing the settlement of the escrow sum. In my opinion, that debate did not constitute an investigation, and further examination of the nature and scope recommended by KPMG Peat Marwick Hungerfords in their letter of 26 April 1988, was clearly called for. Mr Copley was unable to recall, in interviews with the Investigation, whether any further work was conducted, and was not able to produce any documentary evidence of further follow-up work.

Mr Clark has stated to the Investigation that if he had become aware of the findings and recommendations of KPMG Peat Marwick Hungerfords in their letter of 26 April 1988 he would have stopped the transaction from proceeding. He stated that he was under the impression that due diligence had been conducted after the original presentation to the Board on 17 February 1988. The basis for this assumption was that there was an understanding that the Board's approval at this meeting was conditional on due diligence having been performed. The submission from Piper Alderman, Barristers & Solicitors, on behalf of certain of the Bank Directors, also asserts this understanding. Mr Macky, in his evidence to the Investigation, was of a similar impression and acknowledged that, with the benefit of hindsight, it was reasonable for the Board when it approved the purchase on 29 March 1988 to have assumed that due diligence had been conducted after its approval in principle on 19 February 1988. Mr Copley was of the view, in his evidence, that there was no basis for the Bank to make that assumption. Mr Macky has, since his earlier evidence, asserted in a submission on his behalf by Finlaysons, that on reflection and with the benefit of hindsight, he believes that the Board should have felt that some due diligence investigations had been completed, but not the entire exercise, otherwise there would have been no need for inclusion of an escrow amount nor to appoint an investigating accountant and actuary.

On the basis of the enquiries and reviews of the Investigation, I have concluded that, in all probability the follow-up of the advice and recommendations of KPMG Peat Marwick Hungerfords was not conducted. In the circumstances of the transaction such work was, in my opinion, clearly called for. In my opinion, this omission is one of the most significant deficiencies of the due diligence process; and, on the basis of the evidence and material available to me, it was Mr Copley's primary responsibility to ensure that it had been completed, and that the Board was informed both of the contents of the consultants reports, and the satisfactory disposal and clearance of all material issues that were raised.

Mr Copley both failed to pursue the further enquiries, and subsequently executed the Deed of Release which released the vendor from the warranty obligations (except for a single taxation warranty) of the Sale Agreement. The Bank management, therefore, not only failed to pursue potential warranty claims, but also placed the Bank in a position where it was no longer able to pursue these matters in the future. It should be emphasised that the Deed of Release was executed within a month of Mr Copley's having been advised by KPMG Peat Marwick Hungerfords to conduct more detailed investigations.

Mr Copley acknowledged, in interviews with the Investigation, that he decided to enter into the Deed of Release without further follow-up action on the issues raised by KPMG Peat Marwick Hungerfords. He further acknowledged that Mr Clark would not have been aware of any recommendations for follow up action at the time the Deed of Release was executed. Mr Clark also denied even being made aware of the findings and recommendations of KPMG Peat Marwick Hungerfords and Mercers.

Mr Copley has told the Investigation that the decision to release the vendors from their warranties was consistent with a "handshake" deal made between Mr Clark and the vendor. He alleged that the understanding was that Oceanic Capital Corporation would be acquired by the Bank on a "walk in - walk out" basis. As he put it, "we bought the company warts and all." The Investigation questioned Mr Clark who denied being involved in negotiations with the vendor, or having made any agreements of the nature referred to by Mr Copley. Mr Clark advised the Investigation that Mr Macky and Mr Copley were responsible for the transaction, and any such decisions would have been made by either one. Mr Macky told the Investigation that although he was not aware of any "handshake deal" made between Mr Clark and the vendor, during the later stages of negotiations Mr Clark had a discussion with Mr Carter, and as a consequence of that meeting there was an increase in the pressure to complete the transaction speedily. Mr Clark acknowledged that he had discussions with Mr Carter, but only in relation to salary packages for senior executives.

17.4.4 RELEVANT CONCLUSIONS

The actions of senior Bank executives responsible for the above decisions were imprudent and lacked competence, in that they unnecessarily exposed the Bank to significant financial risk by the cumulative effect of the following:

(a) The Bank making the investment in Oceanic Capital Corporation prior to conducting any detailed due diligence investigation.

(b) Placing the Bank in a position where subsequent price adjustments could only be readily made against an escrow amount of $2.0M which was not sufficient to cover any material claims relative to an original purchase price of $60.0M.

(c) Placing the Bank in a position where it would have to rely on warranties in the Sale Agreement to recover any claim in excess of $2.0M from the vendor which is necessarily more complicated and difficult to achieve.

(d) Exacerbating the risks of (c) by failing to heed the advice of its lawyers to include adequate warranty protection for the Bank in the Sale Agreement and in doing so, not following the conditions incorporated in the Bank Board approval for acquisition of Oceanic Capital Corporation.

(e) Failing to act on the advice of KPMG Peat Marwick Hungerfords to conduct adequate investigations to identify potential warranty claims.

(f) Agreeing to release the vendor from its warranties under the Sale Agreement in circumstances where they were on notice from KPMG Peat Marwick Hungerfords that significant problems existed in Oceanic Capital Corporation that required further investigation which might reasonably have been expected to identify potential warranty claims against the vendor.

The Board's role is discussed in more detail in 17.7 hereunder.

On the basis of the above mentioned matters, I am of the opinion that Mr Copley and Mr Macky failed to exercise proper care and diligence in carrying out those aspects of their duties referred to above.

17.5 FINANCIAL PERFORMANCE OF INVESTMENT

The Investigation has reviewed and analysed the performance of Oceanic Capital Corporation in order to:

(a) compare the actual performance with the original forecasts included in the Oceanic recommendation, used to justify the acquisition of Oceanic Capital Corporation; and

(b) identify losses incurred by Oceanic Capital Corporation which should have been detected in the Bank's due diligence.

Set out below is a summary of the audited results of the Oceanic Group for the nine months ended 30 June 1988, and the three years ended 30 June 1989, 1990 and 1991.()

|

9 Months |

Years Ended 30 June |

|||||||

Entity/Item |

1988 |

1989 |

1990 |

1991 |

||||

| Oceanic Life Limited Australia New Zealand General Fund |

) ) ) |

|

|

|

|

|||

| Pendock Pty Limited |

(769) |

(320) |

856 |

(93) |

||||

| Oceanic Funds Management Limited |

|

|

|

|

||||

| Oceanic General Limited |

(1,421) |

(556) |

16 |

6 |

||||

| Non-operating subsidiaries |

82 |

7 |

(49) |

(94) |

||||

| Oceanic Capital Corporation Limited |

|

|

|

|

||||

| Group Net Profit/(Loss) After Tax and extraordinary items |

|

|

|

|

||||

|

[sic] |

||||||||

* Oceanic Capital Corporation was formed in August 1987.

The investment in Oceanic Capital Corporation has never achieved the forecast profits presented in the Oceanic recommendation, nor has it ever achieved the 15 per cent per annum return on investment required by the Bank.

I have set out under the following sub-headings, issues arising from the Investigation's review of results for each of the relevant accounting periods described above.

17.5.1 NINE MONTHS ENDED 30 JUNE 1988 ($15.2M LOSS)

This is an important period because it straddles the acquisition date (31 March 1988) of Oceanic Capital Corporation. The loss of $15.2M includes both pre- and post-acquisition profits/(losses) and also includes the write-downs and revaluations made on acquisition of Oceanic Capital Corporation. My review of this period has therefore attempted to identify each such component, and its impact on the reported result.

(a) Pre-Acquisition Results

The Investigation has reviewed the monthly Oceanic Capital Corporation finance reports prepared as Oceanic Board Papers from January to May 1988 and set out below are relevant comments:

|

Month |

Year |

Comments |

|

January 1988 |

3.5 |

This result provided the basis of acceptance of forecast achievement by the Bank management |

|

February 1988 |

2.5 |

This was briefly reviewed by KPMG Peat Marwick Hungerfords during their investigations on behalf of the Bank but not confirmed. KPMG Peat Marwick Hungerfords has recommended in a letter dated 26 April 1988 to Mr Copley that they be engaged to verify the management reports at 31 March 1988 to "give you [Mr Copley] and your Company the appropriate comfort as the reliability and accuracy of what becomes the staring point". The investigation was advised by Mr Pitcher that KPMG Peat Marwick Hungerfords did not receive further instructions from Mr Copley to conduct this work. |

|

March 1988 |

2.4 |

This trading profit subsequently become a trading loss of $1.2M after $3.6M of additional expense accruals were booked. |

|

April 1988 |

N/A |

Mr Reichert advised that a finance report probably was not prepared because Oceanic Capital Corporation management would have been distracted by the acquisitions process. |

|

May 1988 |

2.6 |

The $3.6M adjustments for additional expenses had not been recorded at this stage, therefore the management accounts imply that $0.2M in additional net profit had been recorded since March 1988. |

(b) Post-Acquisition Results

The finance report for June 1988 prepared for the Oceanic Capital Corporation Board of Directors did not provide the usual year to date trading result analysis for group operations. It did, however, note "Indications are that the Group will make a profit of approximately $3.1 million for the 3 months ended 30 June 1988." [emphasis added]

It should be noted that the three months ended 30 June 1988 is an important period because any profit or loss for Oceanic Capital Corporation from 31 March 1988 onwards (ie post-acquisition results) would be consolidated in the State Bank Group results in accordance with generally accepted accounting principles. Indeed, the Bank's 1988 Annual Report disclosed a $3.1M profit contribution from the Oceanic Group, which would only include Oceanic Capital Corporation results for the three months ended 30 June 1988 (the post-acquisition period). I question the accuracy of the reported result, and believe there is a likelihood that the $3.1M profit for the three months ended 30 June 1988 included some portion of pre-acquisition profit for the following reasons:

(i) The May 1988 finance report indicated only $0.2M of profit had been earned in the two months from 31 March 1988 which therefore implies that the majority of the $3.1M profit was generated in June 1988.

(ii) It is unlikely that a $3.1M profit for Oceanic Capital Corporation could have been generated in a single month given the historical and forecast levels of profitability.

(iii) A handwritten file note of Mr Copley was attached to a version of the March 1988 balance sheet included in a memorandum from Mr Reichert dated 24 June 1988. This note referred to adjustments of $3.0M to the March 1988 accounts which indicated that some provisions had been made with the effect of transferring pre-acquisition operating profit into post-acquisition operating profit to be recognised prior to June 1988. This notation is made in the following terms:

"Timing Differences

1. Approx $3M to be brought back June 88."

(iv) In meetings with the Investigation, Mr Copley confirmed his practice of establishing pre-acquisition provisions for reversal into post-acquisition profit and confirmed that this occurred in relation to Oceanic Capital Corporation. Whilst he could not confirm that the accounting entries had been made, he did agree that, based on the file note referred to above, the profits of the Bank earned from trading had been overstated by $3.0M in the year ended 30 June 1988. The auditors have submitted that, given the lack of precision involved in apportioning profit, the post-acquisition profit was acceptable for audit purposes.() I accept that any mis-statement in post-acquisition profit of Oceanic would not have been material in itself in relation to the Bank Group's profit for the year.

Mr Reichert has reviewed the additional amounts booked as expenses at 31 March 1988, and provided an analysis of each item included in the $3.6M amount. Although this analysis has given some background on the underlying nature of the accruals, it is not sufficient to confirm the extent to which the results for the three months ended 30 June 1988 included pre-acquisition profit. This matter requires review in order to determine whether there were reasonable grounds upon which to confirm the accuracy of the reported post-acquisition profit. This review has been conducted in the context of the external audit review pursuant to Term of Appointment B.

The deliberate inclusion of pre-acquisition profits in the post-acquisition results would raise the following significant issues:

(i) The prospective overstatement of the reported net profit after tax of the State Bank Group for the year ending 30 June 1988 by the inclusion of Oceanic Capital Corporation pre-acquisition profit in the post-acquisition results for 1988.

(ii) Doubts as to the underlying authenticity of the Bank accounts generally.

(iii) On the basis of what was done, whether the actual lack of profitability of Oceanic Capital Corporation for the three months to 30 June 1988 should have alerted Bank management to the possibility that the forecast profitability for Oceanic Capital Corporation was not achievable.

On the other hand, if a significant portion of the $3.6M of expenses actually were incurred in the six months to 31 March 1988, then it follows that the pre-acquisition results reviewed in the due diligence process were, in fact, substantially overstated. If this were so, then the premise for Bank management's accepting the achievability of the 1988 forecast (ie the reported year to date profits of $3.5M at 31 January 1989) was also incorrect. In my opinion, such an overstatement of profit is likely to have been detected in due diligence if the review had included an analysis of year to date results. In this context, I note that KPMG Peat Marwick Hungerfords were not requested to pursue such further investigations, despite the recommendations to that effect in paragraph 3 of their letter of 26 April 1988. In my opinion, had such due diligence reviews been adequately and competently performed then doubts over the achievability of forecasts would have arisen.

On the basis of the matters referred to above, I am of the opinion that a significant portion of the post-acquisition result for the three months ended 30 June 1988 was, in reality, attributable to pre-acquisition earnings. This approach is contrary to generally accepted accounting practice.

(c) Impact of "One-Off Items" on Reported Result for Nine Months Ended 30 June 1988.

The Oceanic Capital Corporation reported loss of $15.2M for the nine months ended 30 June 1988 was influenced by the following "one-off" items, which should be excluded from the results to identify "normal" operating profit for the period:

| Item | $M |

| (i) Adjustments to asset values as identified by the Bank in order to establish an opening balance sheet for Oceanic Capital Corporation (referred to as "acquisition adjustments") |

| . Adjustments to GAAP reserves

- elimination of policyholders share of unrealised property gains |

(7.8) |

| - overstatement of deferred acquisition costs | (2.4) |

| - increase in liabilities | (3.0) |

| . Write-down of Life Licence | (0.5) |

| . Write-down of value of Agency network | (3.9) |

| . Write-off of goodwill | (1.3) |

| . Write-down of investments | (0.8) |

| (ii) Other items not attributable to normal operating profit |

| . Profit on sale of subsidiary (Credit Card Sentinel Pty Limited) | 3.2 |

| . Over provision of prior year income tax

Total |

1.1

(15.4) |

By excluding the "one-off" items identified in the analysis above from the reported loss of $15.2M, it may be interpreted that the Oceanic Group actually only recorded a marginal profit for the nine month period. If this was, indeed, the case, it is impossible to accept the $3.1M profit reported for the three months ended 30 June 1988 further supporting the suspicion that there has been a shifting of pre to post-acquisition profit in this period.

17.5.2 YEAR ENDED 30 JUNE 1989

In the year ended 30 June 1989 Oceanic Capital Corporation achieved a net profit (after tax) of $1.5M. This compared with a budgeted net profit for the same period of $8.2M. The budget for the year ending 30 June 1989 was not significantly different from the forecast for the year ending 30 September 1989 contained in the Oceanic recommendation. An Oceanic Capital Corporation Board Paper prepared by Mr Purvis, Managing Director, dated 15 August 1989 provided an analysis of the causes for the unfavourable result against budget, and identified the following significant one-off items. The items are quoted from the Board Paper in the table below:

".....

|

Effect |

||||

|

1. |

a. | Write-off of agent loans accumulated over the last ten years or so. |

(900) |

|

| b. | Stamp Duty assessed for the period 1984-87 and not covered by warranties given to State Bank by APA Holdings |

(949) |

||

| c. | Change in basis of valuation of policy reserves for Australia. |

(1,271) |

||

| 2. |

a. |

Effect of weaker NZ dollar on translated value of surplus. |

(1,340) |

|

|

b. |

Release of Section 50 reserves. |

3,900 |

||

|

c. |

Change in basis of valuation of policy reserves for NZ. |

(1,324) |

||

|

4. |

Pendock realised losses, funding costs and unrealised losses. |

(3,265) |

||

|

6. |

Effect of the unbudgeted investment advisory success fee. |

1,200 |

||

|

$(3,949) |

||||

..."

The Managing Director's report noted that Oceanic Capital Corporation had reduced the number of agencies "from over 750 to less than 50".

The rationalisation of the agent network raises a separate issue, namely, that some doubt would have to be cast over the carrying value of the agency network at 30 June 1989, which had been carried forward as an intangible asset at $13.5M. Mr Copley advised the Investigation that he raised this issue at an Oceanic Capital Corporation board meeting, and was told that there was significant worth in the Returned Servicemens League connection and no adjustment was warranted. The value attributed to the Agency network was reviewed prior to the acquisition, and was originally assessed by Mr Copley and Mr Macky to have no value. As previously discussed, the final purchase accounting entries did not reflect this write-down. The life agency network has subsequently been written off in the year ended 30 June 1991.

The Investigation requested Mr Reichert to provide details of the change in the basis for the valuation of policy reserves in Australia and New Zealand (items 1(c) and 2(c)). Mr Reichert advised that the valuation revision related to subsequent reviews of anticipated expense levels, bonus rates, and interest rates, which were not envisaged at the time of preparing the budget.

The release of Section 50 (Life Insurance Act 1945) reserves noted at item 2(b) relates to the release of an accumulated surplus in the New Zealand statutory fund. This represented a change in Company policy, whereas previously Oceanic Capital Corporation recognised its share of the New Zealand insurance reserve in accordance with Australian statutory limitations. This change in policy was not anticipated in the budget.

The losses referred to in item 4 relate to a subsidiary of Oceanic Capital Corporation, Pendock Pty Limited ("Pendock"). I understand from interviews with Mr Copley and Mr Reichert that Pendock was acquired as a "shelf company" in May 1988 to acquire, at book value, certain non-performing investments (known as "dog stocks") from equity unit trusts managed by Oceanic Capital Corporation. Mr Copley advised me that this arrangement was entered into in order to improve the performance of the Oceanic Capital Corporation unit trusts and hence attract new investor interest.

Oceanic Capital Corporation Board Papers and Bank Lending Credit Committee papers indicate that a $40.0M facility was established with the Bank to fund Pendock's acquisitions, of which approximately $20.0M was drawn down. Mr Copley told the Investigation that this was provided by the Bank as an indication of good faith and to demonstrate the Bank's support to Oceanic Capital Corporation. It was his understanding that the $20.0M was to be used to remove some of the "dog stocks" out of the company and to better the performance of those funds.

The Investigation questioned Mr Reichert on the intended purpose and function of Pendock in the Oceanic Group. In particular, Mr Reichert was requested to:

(a) explain why Pendock acquired units in trusts managed by Oceanic Capital Corporation;